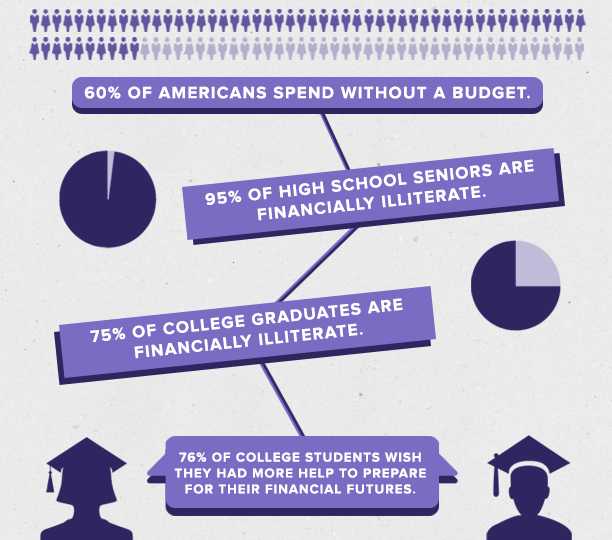

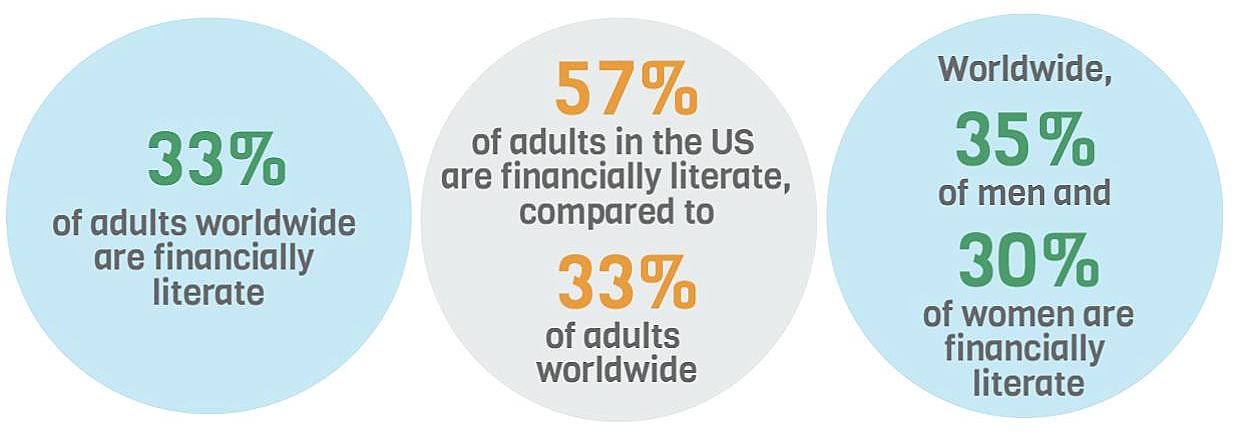

Financial literacy is something we can benefit from at all stages of life. From saving for a college education to getting by in retirement, many people today are feeling extreme financial anxiety and are looking for answers. Unfortunately, many Americans are unfamiliar with even the most basic economic concepts needed to make saving and investment decisions. In fact, research shows that more than half would fail a basic finance quiz. This lack of financial knowledge presents serious barriers in home purchases, retirement planning, and other financial choices. A well-informed consumer is critical to a strong and stable economy. While there are no guarantees or one-size-fits-all solutions to every monetary situation, knowing a few fundamentals could do wonders for your finances and your peace of mind. I hope my essay show you the importance of financial literacy and my solution for the financial illiterate crisis that is happened in American right now.

https://dmfinancialliteracy.org/index.php/financial-literacy/what-is-financial-literacy. Accessed 02 May 2019.

Most people know how to open a credit card account, how to deposit money into their accounts, and how to use their credit cards, but how many people really know what terms like APR mean, what banks do with the deposited money, how Social Security works, or the difference between a 401k and a Roth IRA? Financial skills are one of the most important skills that everyone should have and master. From understanding special terms on the bills to how different type of loans work to understanding the income taxes, and insurances, everything nowadays requires one to have basic financial skills, but our education curriculum tends to overlook this and many parents do not have the time to teach their children to deal with their money issues. The result is the big amount of debt that Americans incurred, especially students who were not taught to manage their loans. We spend most of our time investing in finding our perfect jobs, but we are not taught to manage the money we make from the job. Our education system needs to make financial courses more accessible and encourage people to take it in order to prevent detrimental financial decisions that could ruin a person’s life and prevent an upcoming financial crisis. More accessibility and variability to the courses would result in a generally better economy.

Without the financial knowledge, it is easier to make bad decisions that could potentially have a big impact on our life and we become more susceptible to frauds and scams. If financial classes are not available for everyone, individuals are missing the foundation to be able to make better decisions and maximize their successes. There are many problems an adult might face that requires them to know more than just basic math. An adult could face many financial decisions that have tremendous impacts on their later lives. First off, they will face their student loans, then they will have to borrow money for their first house, or first car. They will also need to understand different types of insurance throughout their lives. According to a study from Texas Tech, they found out that people make bad savings decisions because “they are financially illiterate, not because the information provided them is too complex” (Satter and Marwitz). In simple words, people keep making poor decisions on simple things that are easily prevented if they were more informed. An uninformed person is also an easier target of plenty types of scam and fraud. Nowadays, with online transactions, purchases increase significantly along with more advanced type of scams and frauds. According to Cairine Wilson, a vice-president of corporate citizenship at CPA Canada, she claimed that over 33,016 complaints from marketing fraud with more than $43.5 million in losses because the citizens did not have the knowledge to deal with such frauds. The mass loss occurred because the majority of the population was financially illiterate and were unable to deal with this new type of fraud. Although teenagers might claim this is not a problem because such frauds are obvious and hard to scam anyone, really they miss that there are many light-hearted and credulous people that would become an easy target to these frauds. Overall, with limited financial knowledge, one is more vulnerable to be scammed and easier to make bad decisions for their financial lives; additionally, a low financial knowledge population would heavily affect the country’s economy.

https://gflec.org/initiatives/sp-global-finlit-survey/. Accessed 02 May 2019.

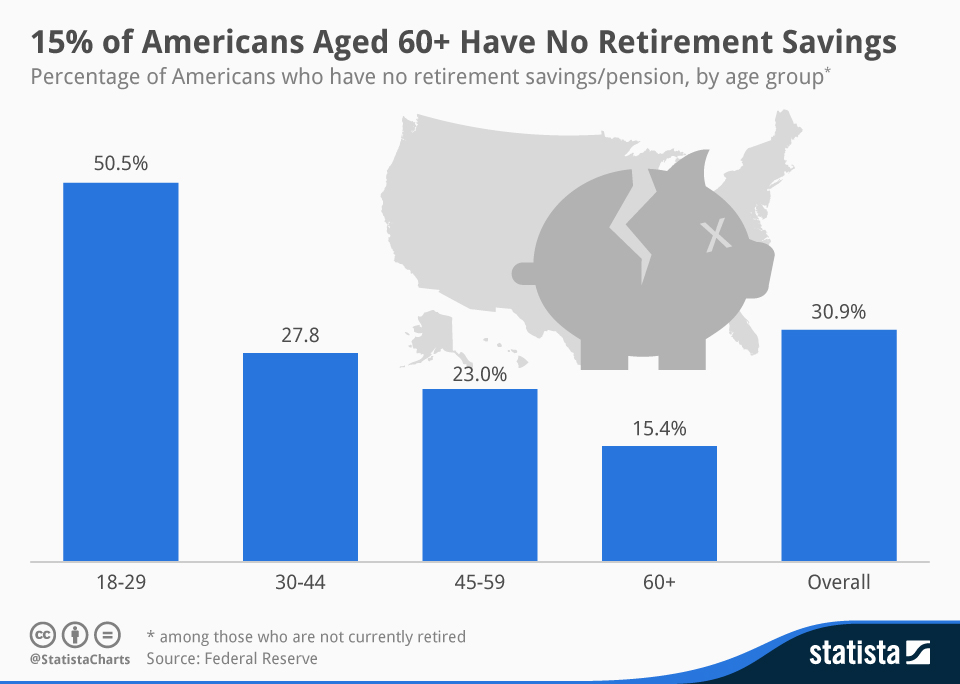

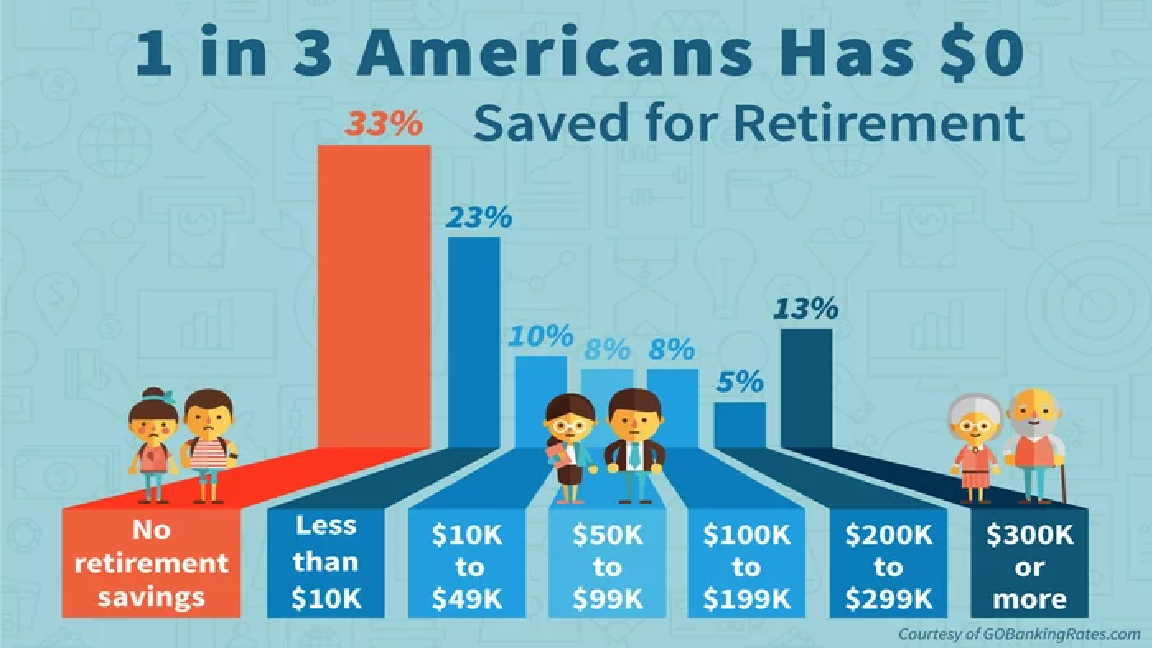

Financial illiteracy contributes to a bad economy that could easily lead to a financial crisis and would also affect a person’s happiness in life. When the majority of the citizens are uneducated about financial matters, it worsens the economy and leads to a financial crisis. Without the basic financial knowledge, we make terrible decisions and accumulate more and more debt; thus, financial illiteracy affects the allocation of financial resources and financial stability at both the micro and macro levels. According to Klapper, the 2008 financial crisis that resulted in significant losses for the economy was contributed by financial behaviors. The people’s lack of knowledge about their loans, debts, and the stock market that has an enormous effect on the economy. They took out loans without knowing how the loan works, they put money in stocks and trust funds without researching about the markets; moreover, such bad decisions from the lack of knowledge have increased their debts significantly and effect the country’s economy on different levels. The lack of knowledge about money issues might also lead to an unhappy and stressful life. We would miss out great opportunities in our lives and would always feel stressed out when we cannot understand and control our personal finances. According to Nate Geraci, the president of an investment advisory firm in Kansas City, 72% of Americans reported feeling stressed out about money matters and 28% feel depressed from financial anxiety monthly. Americans stress about money since they do not have enough knowledge on the subject; thus, they have health issues from extreme stress and easily lead to an unhappy life. Although the poorest or the wealthiest class tend to say, “Money can’t buy happiness,” really they miss that money solves most of the problems in lives and lets us have a more stress-free time. People use this as an excuse for their inability to get out of poverty. Overall, a financially illiterate population would easily lead to a financial crisis and an unsatisfied life; additionally, more accessibility and variability to financial courses could solve the root of the problems.

https://commons.wikimedia.org/wiki/File:Outdoor_Classes_(3944501231).jpg . Accessed 02 May 2019.

With various and easy access to financial courses, it will reduce financial illiteracy by helping the majority of the population, especially the low-income class, improve their financial well-being and also reduce the gap between the rich and the poor. Making the courses more accessible would help the low-income class to fight back financial illiteracy. Low earners usually do not have the money to access to such courses; thus, they are lacking knowledge to control their hard-earned money. According to Dr. Liezel Alsemgeest, a lecturer for the University of the Free State, the students who have taken some financial literacy education tend to have a more effective financial behaviors that could lead to better decision making. Financial education could help us fight back the financial illiteracy crisis in the lower-income class who are suffering from the lack of knowledge. More variability and accessibility to financial education also help reduce the gap between the rich and the poor; thus, it helps generate a better economy. Low income is not the reason why most people stay poor; it is because of their bad financial behaviors and terrible decision making. According to Niall Ferguson, senior research fellow in Oxford, the rich get richer by having the best education from elite schools, while the poor only get a high school diploma. Not having equal education, the low-income class face more trouble in their lives and lose money on unnecessary things, so they keep remaining poor and cannot escape from it. Educating the youth by offering free and various financial classes would improve one’s financial well-being and narrow the gap between the rich and the poor.

Despite these benefits, educators may protest that financial classes are a waste of time because they do not stick, and they offer no real result. They believe that this might be a problem because traditional financial education is boring and most of the time are irrelevant to the student’s lives. According to an analysis of Lynch, Fernandes and Netemeyer, almost everyone who has taken a financial literacy class retained nothing (Mike Dang). Students easily forget boring and unrelated coursework. However, they overlook the fact that the information that we learn is the foundation for better thinking and decision making. They may also argue that financial courses have no significant result. According to Alison O’Connel, a therapist with eleven years of experience, financial literacy education would not make any noticeable difference in our behaviors. She believes this because she cannot connect the information that they learn with real life situations. Although this may be a problem at first glance, she miss that a new approach away from the traditional textbook will be more helpful because it is more feasible and practical. Overall, offering free voluntary classes with an “outdoor” approach is the best plan because it helps us retain more information and connect us with real life situation.

Therefore, we must open and promote “outdoor” financial clubs and groups. First, we need to ask for volunteers and donations to establish new clubs, groups and competitions to attract students. Then, we need to find voluntary teachers so that the course would be available to everyone for free. Competition with prizes would capture attention from students. Second, we need to establish a more practical method to help the learning become more effective. Instead of learning from a textbook and doing homework, we could have students deal with a real-life situation about insurance, bills, debts and loans to figure out the best solution in each situation. Practical methods like this would certainly retain longer in student’s memory, it would be more helpful in real life issue than learning about financial terms.

Due to continued frauds and bad decision making, we should educate our young generation because it is the foundation for a better life with better informed decisions by offering a free class with the new “outdoor” method. The gap between the rich and the poor is widening because of the lack of knowledge in the lower class. Scams and frauds happen every day and result in massive losses to uninformed workers. Financial illiteracy could lead to owning large amounts of debt, making poor decisions, becoming victims of predatory lending and resulting in bad credit. We need to promote financial literacy education by showing their indisputable benefits and making it more accessible for all classes. Despite it seeming ineffective at first, despite it being difficult, despite it being worthless and a waste of time, financial education improves one’s financial well-being, and it becomes the foundation for informed decisions: make financial education available to everyone.