When I started to earn and spend my first few dollars, I had the urge to learn more about savings because I could understand the hard work that I need to go through to earn them. My parents are always too busy to teach me the basics of my financial life, so I did all the research on my own. While I was doing the research, I noticed that many young millennial and even adults do not have any savings for their retirement. At first, I did not see this as something I should care much about when I am still in school, but after I realized the benefits of saving for retirements, I want to share my views on the matter and hope that everyone would also realize the benefits of saving for retirements at an early age.

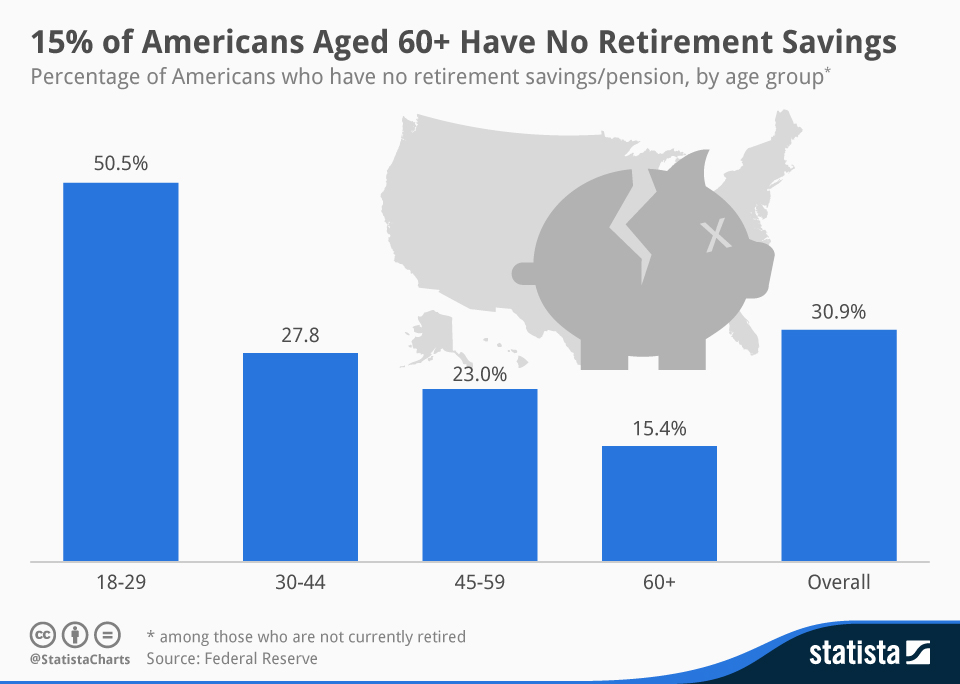

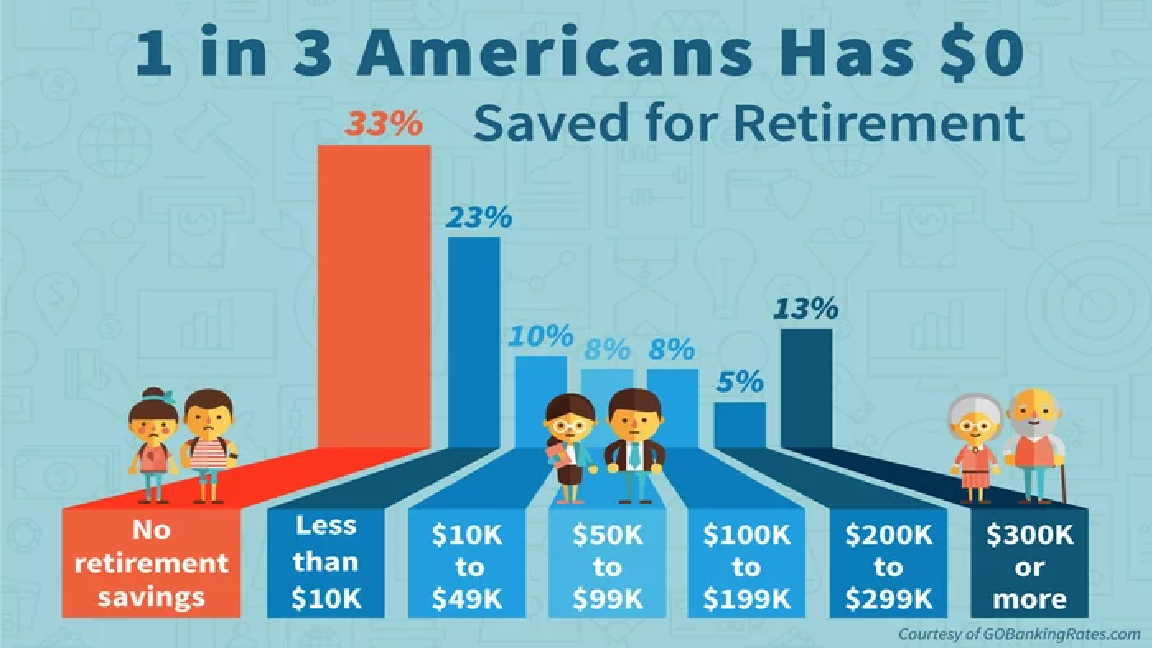

According to Matthew Frankel, an investment specialist with a graduation certificate in financial planning, Social Security is estimated to replace only 40% of our income. In 2034, the Social Security’s fund will be depleted, but it is currently responsible for 27 million people to stay off the poverty line with one-third of Americans have absolutely nothing saved for retirement (Frankel). Even though the importance of saving for retirement is certainly indisputable, Americans ignore the benefit of their retirement saving. A retiree will depend on Social Security’s money to survive, but it is shown that Social Security alone will not provide enough for an elder’s need; therefore, having a retirement account is crucial. Even though there are many benefits of saving for retirement, many millennial rarely think about retirement with various reasons such as having low incomes or rather spending on the goods now with the hope that their future would sort themselves out. The reality is that lots of elders have to re-enter the workforce after their retirement because they cannot afford to pay their bills. Planning and saving in a retirement account as early as possible would be helpful because Social Security is not as reliable anymore, parents do not want to become financial and emotional stresses to their family, and saving accounts are usually tax-deferred which could help reducing tax money.

https://www.statista.com/chart/2561/americans-with-no-retirement-savings/. Accessed 07 April 2019.

Having Social Security as the only source of income after retirement would alter the current lifestyle and usually result in a significant amount of debt. According to Jon Gorey, a multiple-award winner from the National Association of Real Estate Editors, 61.3 % of households that are headed by adults aged sixty or more have an average debt of 40,000 dollars. Social Security’s funds are usually not even enough for mandatory bills and food which makes people adjust their lifestyle in order to be able to pay their bills. Moving to retirement is a really difficult transition that most people find hard to adapt because it usually results in a giant debt for them that make many people reenters the workforce. According to Frankel, in 2018, a retired couple who retires at age sixty-five can expect to pay around $280,000 out-of-pocket for healthcare costs during their retirements. As their age increases, their immunizations decrease significantly. The same flu could have no serious impact on a young, healthy adult, but it could put an elderly person into a deadly position. While some may argue that Medicare would pay for most of the medical expenses, there are lots of medical expenses that Medicare does not cover. Medicare does not pay for serious, long-term treatment and a lot of different services, so it is always better to prepare to save for medical expenses. Ultimately, Social Security may not be reliable and enough for everyone because it alters people’s lifestyle and unexpected costs would result in debts; furthermore, saving for retirement early would prevent the parents from becoming a burden to the children.

Without saving for retirement, most elders will easily drive up their debts and bring stress to their children or spouses with unpaid bills. Cameron Huddlestone, an award-winning journalist with fourteen years of experience as the chief editor, claims that low-income parents will be more likely to move in with their children. According to Frankel, half of Americans cannot handle a $400 unexpected fee without selling personal items or borrowing money. As low-income parents retire without any savings, they have to move in with their children, so that their children would help them to pay off bills and unexpected costs. The parents now become a financial burden to their children who now might not have enough to save money for their own retirement. According to Jeffrey Dew, who has a double title in PhD-HFDS and Demography about family studies, couples with no actual savings and a high level of debt report a higher level of anxiety, while couples with a financial plan for retirement report greater health over time. Couples with no planning for retirement usually also do not have a good strategy for savings. Without any savings, couples often accumulate lots of debts from unexpected costs and bills which exert a great deal of stress on them. On the other hand, having a retirement account could lead to a stronger body and healthy mind over time because it provides a secured feeling for the future that could reduce a lot of stress which is connected to life-threatening illnesses like heart attack, kidney diseases, and cancer. While young people may argue that it is their duty to pay the bills and take care of their parents when they retire, most parents do not want troubles to their kids. All parents want to see their children thrive and be successful in life. No one would ever want to be in an awkward and stressful situation with their children figuring out how to pay their bills. Overall, planning for retirement could keep elders from becoming too dependent on their family, and it could also protect marriage relationships; furthermore, a retirement account is usually eligible for tax deduction.

In addition, opening a retirement account could result in reducing income-deductible tax and having incredible health insurance benefits. According to Paula Thielen, a physician about family medicine, a traditional individual retirement account allows taxpayers to set aside tax-free money for retirement while offering tax advantages. The traditional individual retirement account deducts a desired amount from the payroll to the portfolio before any taxes which would reduce the taxable income. The investment, then, would stay tax-free and grow exponentially until withdrawal. The longer the money stays in the portfolio, the less percentage of the profits would be taxed upon distribution. Another type of retirement account that offers great health cost benefit is the health saving accounts (HSAs). According to Tacchino, a professor of taxation and financial planning at Widener University, HSA is the most effective way to save for retirement and also pay for retirement medical expenses because of its abilities to make before-tax contributions with exponentially tax-free growth, and tax-free distributions. HSA has plenty of benefits that exceed a normal retirement account. Even though it has the same benefits of tax-free contribution like a traditional saving account, it also offers tax-free withdrawal for any current or future medical expense which a traditional retirement account does not have. Lots of people use this account to pay less for their medical expenses because there is no penalty for early withdrawal. While low-income families may argue that they are living paycheck to paycheck and have no money to save for retirement, there are plenty of ways to cut spending of all unnecessary costs and lower their bills. How do they expect to live and save later in their life if they could not even save when they were younger and at the peak of their lives? Ultimately, having a retirement account could result in a lot of hidden benefits from tax and healthcare insurance costs.

http://money.com/money/4258451/retirement-savings-survey/. Accessed 07 April 2019.

Saving for retirement early could prevent many problems because of the insufficient funds from Social Security for a normal lifestyle, a good relationship with their family and the tax benefits for a retirement account. The growing rate of people with no savings for their retirement account has become a serious issue in America due to ignorance and the YOLO culture from the young generation which encourages living life to the fullest extent and pays little attention to the future. An ongoing debate about spending all and living for now or saving for the future results in no real winner since both lifestyles have their own charms and ugliness. While life is all about spending money on materials and fun experiences, the consequences of not saving and planning are serious that cannot be ignored. Saving all the time, saving in spite of hardship, saving however long and hard, the retirement maybe; for without saving there is no future.

Work Cited

Dew, Jeffrey P. “Family Finances.” The Wiley Blackwell Encyclopedia of Family Studies, edited by Constance L. Shehan, 2016. Credo Reference, search.credoreference.com/content/entry/wileyfamily/family_finances/0. Accessed 16 Mar. 2019.

Frankel, Matthew. “40 Sad Facts About Retirement.” The Motley Fool, 23 May 2018, www.fool.com/slideshow/40-sad-facts-about-retirement/?slide=34. Accessed 07 Mar. 2019.

Gorey, Jon. “Two-Sided Coin: Save for the Future or Live for Today?” The Simple Dollar, 27 Feb. 2018, http://www.thesimpledollar.com/save-for-the-future-or-live-for-today/. Accessed 07 Mar. 2019.

Huddleston, Cameron. “63% Of Kids Plan to Financially Support Parents’ Retirement.” GOBankingRates, 7 July 2017, www.gobankingrates.com/retirement/planning/kids-plan-financially-support-parents-retirement/. Accessed 07 Mar. 2019.

Tacchino, Kenn Beam. “The Health Savings Account Strategy.” Journal of Financial Service Professionals, vol. 71, no. 3, May 2017, pp. 7–10. EBSCOhost, search.ebscohost.com/login.aspx?direct=true&db=bth&AN=122751697&site=ehost-live. Accessed 07 Mar. 2019.

Thielen, Paula J. “Individual Retirement Accounts (IRAs).” Encyclopedia of Business Ethics and Society, Robert W. Kolb, 1st edition, Sage Publication, 2008. Credo Reference, search.credoreference.com/content/topic/individual_retirement_accounts. Accessed 07 Mar. 2019.